Calculation of pension in 2018.

Calculation of pension in 2018.

You can calculate the amount of the pension accrued in 2018 using our calculator for calculating pensions from 45-90. It differs from all others, including the PFRF calculator, in that it takes into account all periods of a citizen's labor activity and calculates the real, and not the hypothetical, amount of pensions. To carry out related calculations – determining the average monthly salary for any period until 2002 and finding the average monthly salary coefficient (AMS), as well as the amount of pension capital earned for the periods from 2002 to 2015, you can use our other calculators.

In order to understand how a pension is calculated and what its size depends on, it is important to know the basic principles for the formation of pension rights, as well as the key details and features of the calculations, which are described below.

General parameters that will be used to calculate the size of pensions in 2018.

- The minimum required insurance period to qualify for an insurance pension in 2018 – 9 years.

(In 2017 – 8 years). - Minimum required value IPK to qualify for an insurance pension in 2018 – 13,8.

(In 2017 – 11.4). - The cost of one pension coefficient (SPK) in 2018 – 81 ruble 49 kopecks

(In 2017 – 78 rubles 58 kopecks). - The amount of the fixed payment (FV) to the old-age insurance pension in 2018 will be 4 982 rubles 90 kopecks. (In 2017 – 4805 rubles 11 kopecks).

What parts does the pension consist of and how is it calculated.

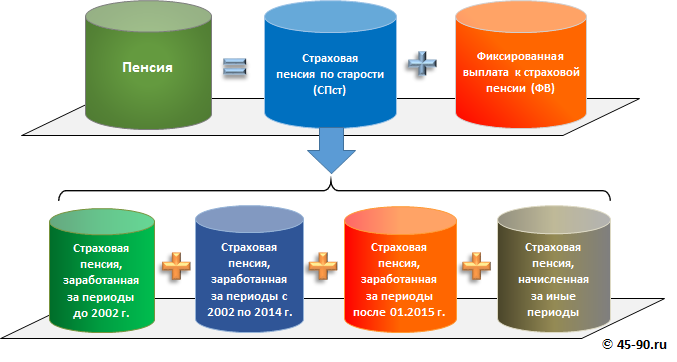

The basic pension that a citizen will receive upon retirement in 2018 will consist of the “Insurance old-age pension” and the “Fixed payment”.

Fixed payment to the insurance pension (FV).

Fixed payout (FV) is added to the old-age insurance pension for all pensioners without exception. Its size in 2018 is 4 982 rubles 90 kopecks.

Law (FZ-400) FV is defined as follows: "Fixed payment to an insurance pension – provision of persons entitled to the establishment of an insurance pension in accordance with this Federal Law, established in the form of a payment in a fixed amount to an insurance pension."

For northerners, disabled people and a number of other beneficiaries, an increased amount of a fixed payment is provided. Details are described in article 17 FZ-400.

Parts of the insurance old-age pension (SPst)

old-age pension (SPst) is formed from four parts – three correspond to different periods of the citizen's labor activity, and the fourth is charged for other periods equated to the length of service.

The insurance pension consists of:

- part of the insurance pension earned for the periods before 2002.

- part of the insurance pension earned for the periods from 2002 to 2014.

- part of the insurance pension earned for periods after 2015

- part of the insurance pension accrued for other (non-insurance) periods.

Individual pension coefficient (IPC)

From January 1, 2015, the pension rights of citizens measure and take into account the magnitude of the "earned" by the individual pension coefficient (IPK) in ballats. To calculate the size of the pension in rubles, it is necessary to know (calculate, calculate) the value of an individual retirement coefficient. When IPK Known, it is multiplied by the cost of one pension coefficient (point) in the year of the prescription of pensions and determine the size of the "Insurance pension in old age" in rubles.

In accordance with the structure of an old-age insurance pension, IPK Also, it is also calculated on the basis of the three main terms with the addition of the fourth, which takes into account the pension rights for "other" (non-insurance) periods – service in the army, the periods of care for children, etc.

IPK = IPC until 2002 + IPC for 2002-2014 + IPC after 01/01/2015 + IPCs for other periods.

For each of the specified periods IPK Determined and calculated in a different way.

Pension rights formed until 2002

(IPC until 2002)

Dependes and are fully defined by three parameters:

- The duration of insurance (labor) experience until 2002.

- The average monthly earnings of a citizen or for 2000-2001, or for any 60 months (5 years) in a row in the period until 01.01.2002 (it is chosen that it is more profitable).

- The duration of the insurance experience until 1991.

Invalious accounting or underestimation of any of the listed parameters can lead to inclusion of the pension size.

Pension rights, earned during this period, first calculated in rubles, and then transferred to IPK. Detailed calculation algorithm IPK until 2002 Described in the article.

The main problem of calculation IPK until 2002 For retiring, in 2018 it is that the Pension Fund (PFRF) Does not have full information about citizens and their employment activities for periods until 2002. Therefore, the value IPK Until 2002 ., Which will give your request, for example, the PFRF Personal Cabinet, as a rule, is not true. If the calculator is calculated on the calculator or on the basis of the "manual" algorithm will show a result other than the one specified in the Personal Account, then proving its rightness in the FFRF will have official documents confirming the experience and earnings (labor book, certificates of earnings, archival documents, etc.). On the presence of such documents and their compliance with the requirements of the FFRF (the necessary seals and signatures) must be worried in advance.

Pension rights formed in 2002-2014.

(IPC for 2002-2014).

Depend on and are fully determined only by the size of pension capital (PC), formed from insurance premiums in the FFRF over the years.

Neither insurance experience – periods of periods in 2002-2014, during which insurance premiums were transferred to the PFRF, nor other parameters, no influence on the size of the insurance part of the retirement earned in 2002-2014. (provided that the general insurance experience is enough to acquire the right to receive an old-age insurance pension).Calculation and assessment of pension rights formed for 2002-2014, produced in rubles based on Federal Law No. 173-FZ, which are then translated into points IPK.

About how pension rights are calculated and IPK for 2002-2014 In detail told in the article.

Information about this period of labor activity and the amounts of the listed insurance premiums are known and recorded on the ILS of a citizen in the PFRF, since since 2002, the Personified Accounting has fully earned fully in the PFRF. Magnitude IPK For 2002-2014 You can find out in your personal account on the website of the PFRF or on the "State Service" website, but it will not be possible to influence and change its size. To control the correctness of the data specified in the Personal Account, IPK During this period, you can calculate either on our special calculator, or "manually" based on the algorithm.

Pension rights, formed after 01.01.2015

(IPC after 01.01.2015).

Dependes and are fully determined only by the sum of insurance premiums received by the Citizen Ils in the PFRF.

From January 1, 2015, after the entry into force of the FZ-400, the calculation method IPK changed. For each calendar year, its value began to count on the formula

IPK year – Individual retirement coefficient, determined by each calendar year since January 1, 2015; St. Year – the amount of insurance premiums accrued and paid for the corresponding calendar year for the insured person; NSV year – the regulatory amount of insurance premiums on an old-age insurance pension calculated as follows

NSV year = 0.16 x before Led. Base.

Before Led. Base – This is the so-called "Limit value of the base for the accrual of insurance premiums" – "Ceiling" annual salary (a growing outcome of January 1 of the relevant year), which accrual insurance premiums in the amount of 22%, of which 16% is based on the formation of the insurance pension (if the accumulative pension has not been formed). With the amounts exceeding this threshold, insurance premiums are also listed in the PF, but already at another rate – in the amount of 10% and they do not come to an individual personal account of a citizen, but in the "Common Boiler" of the Pension Fund. The limit value of the base is annually established by the government's resolutions.

Reference. Values Before Led. Base:

in 2015 – 711 000 rubles; in 2016 – 796,000 rubles; In 2017 – 876,000 rubles., In 2018 – 1,021,000 rubles.

For calculating and evaluating their annual IPKEarned after 01.01.2015, you can use simplified formulas

- IPK2015= (average monthly salary in 2015/59 250) x 10.

It may not exceed 7.39. If it turns out again, then equal 7,39. - IPK2016= (average monthly salary in 2016/66 333) x 10.

It may not exceed 7.83. If it turns out again, it is 7.83. - IPK2017= (average monthly salary in 2017/73,000) x 10.

It may not exceed 8.26. If it turns out more, then equal to 8.26. - IPK2018= ((Earnings for 2018 to retirement) x 0.16 / 163 360) x 10.

It may not exceed 8.7. If it turns out again, it is 8.7.

IPCs for other periods.

For socially significant periods – urgent service in the army, child care and some others are also charged, as a result of which is formed IPCs for other periods. It is charged if a citizen did not work during these periods. The number of points accrued for non-trap periods, according to clause 12, Article 15 of the Federal Law "On Insurance Pensions", the following.

- Coefficient (IPK) During the period of military service for call, as well as service periods and (or) activities (work), provided for by the Federal Law of June 4, 2011, N 126-FZ "On the guarantees of pension provision for certain categories of citizens", is 1.8.

- Coefficient (IPK) For the full calendar year of the other period provided for in paragraph 3 of Part 1 of Article 12 of the FZ-400, is:

1) 1.8 – in relation to the period of the care of one of the parents for the first child until they reach the age of one and a half years;

2) 3.6 – in relation to the period of care of one of the parents for the second child until it reaches the age of one and a half years;

3) 5.4 – in relation to the care period of one of the parents for the third or fourth child before reaching each age of one and a half years. "

The final calculation of the pension

After calculated IPK For certain periods, they are folded and determined by the final value. IPK:

IPK = IPC until 2002 + IPC for 2002-2014 + IPC after 01/01/2015 + IPCs for other periods.

With known IPK The size of the pension appointed in 2018 is easy to calculate. For this IPK multiplied by the cost of one pension coefficient and a fixed payment is added to the amount obtained.

Pension = IPK X 81 ruble 49 kopecks + 4,982 ruble 90 kopeck

Notes.

1. The described algorithm for calculating pensions remains unchanged and applied from January 1, 2015 to today.

2. The most important period, in terms of the possibility of influencing the amount of the accrued pension – the period of labor activity until 2002 on the size of the pension can be influenced by choosing the most profitable wages (for 60 months in a row) and the duration of insurance experience (confirming it necessary documents). To do this, you will have to carefully examine the algorithm for the accrual pension for the periods until 2002.

3. Influence the size of the pension accrued for other periods (after 2002) is difficult – all information on the size of insurance premiums is recorded on ILS in the FFRF and "appealing is not subject to".

4. We described the algorithm for the standard, "standard" insurance pension in old age. In some cases, with early retirement, northern experience and other features, additional subtleties may occur in the calculations. Many of them are discussed and dealt with our forum in the section "Communication". This is a collective piggy bank of knowledge, where you can ask a question and get a prompt about how to properly come in many non-standard situations.

5. Those who participated in the formation of pension savings in NPF or the Criminal Code will additionally receive an additive to the "main" pension in the form of a "accumulative pension". However, since the absolute majority of citizens leaving retired in 2018, the accumulative pension was either not formed, or formed it in very minor volumes, we do not consider it within this article and we will talk about it in other publications.